If you’ve spent any time trading stocks or cryptocurrencies, you’ve likely come across the ascending triangle pattern. It’s one of the classic chart patterns traders rely on to predict potential breakouts. But what happens when this pattern fails? In this post, I’ll walk you through the failed ascending triangle pattern, what it means, and how you can manage it.

Understanding the Ascending Triangle Pattern

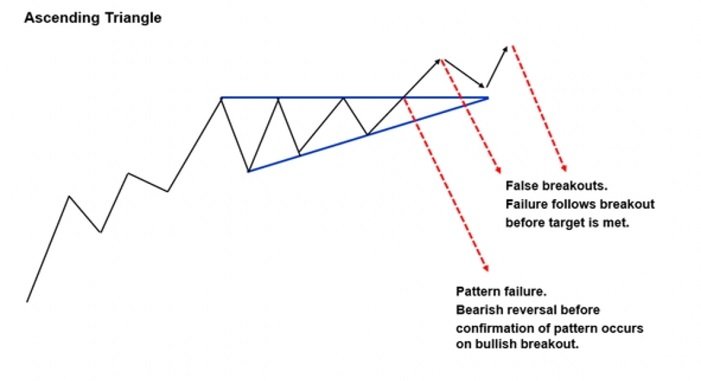

Before diving into the failure of this pattern, let’s quickly recap what an ascending triangle pattern is. This pattern is typically a bullish signal that forms when the price of an asset makes higher lows while encountering resistance at a specific price level. The expectation is that the price will eventually break through this resistance, leading to a significant upward move.

The Reality of Failed Ascending Triangle Patterns

However, like all patterns in technical analysis, ascending triangles aren’t foolproof. A failed ascending triangle occurs when the price doesn’t break out as expected. Instead, it either reverses direction or breaks down below the rising trendline. This can catch many traders off guard, leading to potential losses.

Why Do Ascending Triangle Patterns Fail?

There are several reasons why an ascending triangle pattern might fail:

- Weak Buying Pressure: If there isn’t enough momentum or buying pressure, the price may not have the strength to break through the resistance level.

- Market Sentiment Shift: Sudden changes in market sentiment due to news, economic data, or other factors can lead to a reversal, negating the pattern.

- False Breakouts: Sometimes, the price may briefly break above the resistance level only to fall back below it, indicating a false breakout.

How to Recognize a Failed Ascending Triangle

Recognizing a failed ascending triangle early can help minimize losses. Here are some signs to watch for:

- Break Below the Trendline: If the price breaks below the rising trendline, it’s a strong signal that the pattern has failed.

- Lack of Volume: A genuine breakout is usually accompanied by high trading volume. If the breakout happens on low volume, it might be a sign of a potential failure.

- Reversal Candlesticks: Candlestick patterns such as bearish engulfing or shooting stars near the resistance level can indicate a reversal and potential failure.

What to Do When the Pattern Fails

A failed ascending triangle doesn’t have to result in a significant loss. Here’s how you can manage the situation:

- Set Stop-Loss Orders: Always have a stop-loss order in place to limit potential losses in case the pattern fails.

- Reassess the Trade: If the pattern fails, take a step back and reassess the trade. Look for other signals or patterns that might give a clearer direction.

- Stay Calm: It’s easy to get emotional when a trade goes against you. Staying calm and sticking to your trading plan is essential.

Conclusion

The ascending triangle pattern is a powerful tool, but like any strategy, it’s not infallible. Understanding how and why these patterns fail can give you an edge in the market. By recognizing the signs of a failed ascending triangle and managing your trades accordingly, you can protect your capital and stay ahead of the curve.