Level 1 vs Level 2 Data Futures: What you must know about?

When it comes to futures trading, having access to the right data can make a significant difference in your trading decisions. Two essential types of market data are Level 1 and Level 2 data. Both provide valuable insights, but they serve different purposes. In this blog post, I’ll break down the differences between Level 1 and Level 2 data, helping you understand which one might be more suitable for your trading strategy.

What is Level 1 Data?

Level 1 data provides the most basic information you need to make trading decisions. It includes:

- Bid and Ask Prices: The highest price buyers are willing to pay (bid) and the lowest price sellers are willing to accept (ask).

- Last Traded Price: The price at which the most recent trade was executed.

- Volume: The number of contracts traded at the last price.

This data is generally sufficient for most retail traders who don’t require detailed market insights. Level 1 data gives you a quick snapshot of the market, allowing you to see the current state of supply and demand.

What is Level 2 Data?

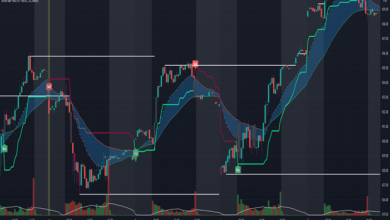

Level 2 data, also known as the order book, provides a deeper look into the market. It includes all the information from Level 1, plus:

- Market Depth: The list of buy and sell orders at various price levels beyond the best bid and ask prices.

- Order Sizes: The number of contracts available at each price level.

- Number of Orders: How many orders are stacked at each price point.

Level 2 data is essential for traders who need to see the full picture of market liquidity. It helps you understand the potential price movements by showing you where large orders are sitting in the market.

Key Differences Between Level 1 and Level 2 Data

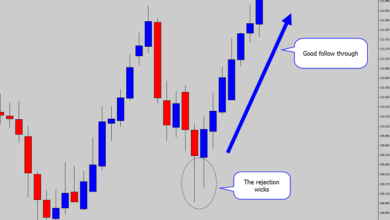

- Market Depth: Level 1 data provides just the best bid and ask prices, while Level 2 shows multiple levels of prices, giving you a better sense of market depth.

- Order Transparency: Level 2 data reveals the size and number of orders at each price level, offering more transparency into market dynamics.

- Trading Strategy: Level 1 is ideal for basic trading strategies, while Level 2 is crucial for more advanced strategies like scalping or day trading, where every price movement matters.

Which One Should You Use?

The choice between Level 1 and Level 2 data depends on your trading style and strategy. If you’re a casual trader, Level 1 data might be all you need. However, if you’re looking to make more informed decisions based on detailed market analysis, Level 2 data is invaluable.

Conclusion

Understanding the difference between Level 1 and Level 2 data is essential for any futures trader. While Level 1 data provides a basic overview, Level 2 offers a more detailed picture, allowing you to make better-informed trading decisions. Whether you’re just starting out or looking to refine your strategy, knowing when to use each type of data can significantly impact your trading success.