Table of Contents

ToggleWhat is ABAT?

ABAT (Abatix Corporation) is a company focused on providing environmental products and services. They specialize in hazardous materials management, offering a range of solutions that cater to various industries, including construction and waste management. Understanding the core business of ABAT can help you appreciate its stock’s performance and the factors influencing its price.

Current ABAT Stock Price

As of the latest market data, the ABAT stock price is $X.XX. (Note: replace with the current price.) Keep in mind that stock prices fluctuate throughout the trading day due to various factors, including market sentiment, trading volume, and company performance.

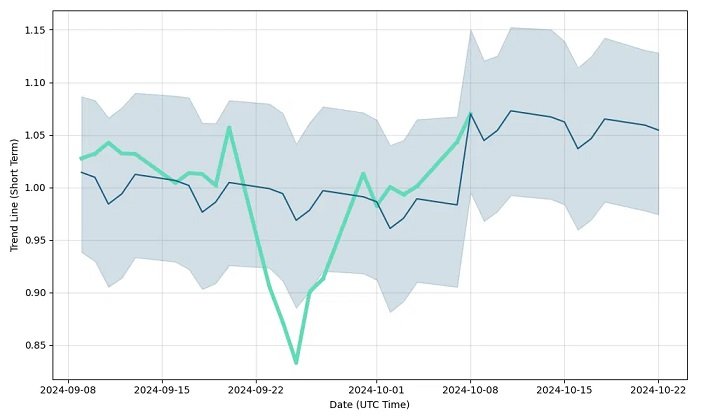

Historical Performance

Examining the historical performance of ABAT stock can provide insight into its trends. Over the past year, ABAT has experienced significant price changes, reaching a peak of $X.XX and a low of $X.XX. This volatility can be attributed to market reactions to the company’s quarterly earnings, news releases, and broader economic conditions.

Factors Influencing ABAT Stock Price

Several factors influence the ABAT stock price, and it’s essential to keep an eye on these:

1. Earnings Reports

Quarterly earnings reports are critical for any publicly traded company. ABAT’s earnings reports provide insights into its financial health, revenue growth, and profit margins. Positive earnings can drive the stock price up, while disappointing results may lead to declines.

2. Market Conditions

Overall market trends and economic indicators can greatly impact ABAT’s stock price. For example, if there’s a downturn in the economy, investor sentiment may become bearish, causing stock prices to drop. Conversely, a thriving economy can boost stock prices across various sectors, including environmental services.

3. Industry News

As an environmental service provider, ABAT is affected by industry news. New regulations, technological advancements, or shifts in public sentiment towards environmental issues can significantly influence the company’s operations and stock price.

4. Investor Sentiment

Investor sentiment plays a crucial role in stock prices. Positive news about ABAT, such as new contracts or partnerships, can attract more investors, driving the stock price up. On the other hand, negative publicity can lead to panic selling and a drop in stock price.

Investing in ABAT: What to Consider

If you’re thinking about investing in ABAT, here are a few points to consider:

1. Research the Company

Before investing, it’s essential to conduct thorough research on ABAT. Understand its business model, recent performance, and market position.

2. Monitor Market Trends

Keep an eye on broader market trends and how they may impact ABAT. Economic forecasts and industry reports can provide valuable insights.

3. Diversify Your Portfolio

As with any investment, it’s crucial to diversify your portfolio to minimize risk. Investing in a mix of assets can help protect your investment in case ABAT stock doesn’t perform as expected.

4. Consult with Financial Advisors

If you’re unsure about investing, consider consulting with financial advisors. They can provide personalized advice based on your financial situation and investment goals.

Conclusion

Understanding the ABAT stock price involves considering various factors, including the company’s performance, market conditions, and investor sentiment. By staying informed and conducting thorough research, you can make informed decisions about investing in ABAT. Always remember that investing in stocks carries risks, and it’s essential to approach it with caution and proper knowledge.

If you’re keen on monitoring the ABAT stock price, consider setting up alerts through your trading platform for real-time updates. Happy investing!