ASTS Stock Forecast for 2025: Is it a Smart Investment?

When looking at ASTS (AST SpaceMobile) stock forecast for 2025, many investors are asking if this space technology company will soar to new heights or face challenges in the coming years. As someone with experience in analyzing stock forecasts, I’ll dive into the most important factors influencing ASTS and what we can expect from it by 2025.

Understanding AST SpaceMobile (ASTS)

AST SpaceMobile is working on a revolutionary technology that aims to provide mobile broadband coverage from space. This company has drawn a lot of attention due to its ambitious plans to build the first space-based cellular broadband network, which can connect users directly to satellites using standard smartphones. The company’s mission is to deliver global connectivity to unserved or underserved regions, and this innovative approach places it at the forefront of the space communications industry.

ASTS Stock Performance So Far

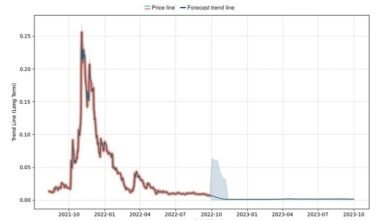

Since its public debut in 2021, ASTS stock has seen both highs and lows. The market for satellite communications is booming, but with great innovation comes great risk. ASTS stock has been volatile, reflecting the uncertainty of whether they can successfully deploy their technology.

Currently, ASTS trades at a lower price than it did at its peak, but long-term investors are holding out hope for significant gains as the company’s technology develops. AST SpaceMobile’s leadership has been confident in their technology, and investors are eager to see how the first full-scale commercial satellite tests go.

Key Factors Influencing ASTS Stock Forecast for 2025

- Successful Deployment of Satellites

AST SpaceMobile plans to deploy a network of satellites by 2025. The success of these launches will be crucial to the stock’s future performance. If the company can achieve this goal, it could revolutionize mobile broadband and significantly drive up the stock price. - Regulatory Approvals

Another critical factor is government regulations. AST SpaceMobile needs to secure approvals in various countries to provide broadband services. The complexity of international regulations might either slow down the company’s progress or add significant challenges. - Competition in Space Tech

ASTS isn’t alone in the satellite broadband race. Companies like SpaceX (Starlink) and Amazon (Project Kuiper) are also working on satellite internet services. This competition could impact ASTS’s market share, but its unique approach of using standard smartphones without extra hardware could give it an edge. - Financial Stability

As a company in its early stages, AST SpaceMobile is not yet profitable. The company relies heavily on investors and partnerships to fund its operations. Keeping a close eye on its financial health, partnerships, and how it manages its resources will be essential to understanding the stock’s trajectory. - Global Market Demand

If AST SpaceMobile successfully deploys its satellite network, the demand for its services could be huge. Billions of people around the world still lack reliable internet access, especially in remote areas. Tapping into this market would greatly benefit the company’s bottom line.

ASTS Stock Forecast for 2025

Bullish Outlook

If AST SpaceMobile meets its satellite deployment goals and gains regulatory approvals, its stock could see significant growth by 2025. Analysts who are optimistic believe the stock could double or even triple if the company successfully proves its technology works on a global scale. Investors should watch closely as the satellite launches unfold in the next few years.

Bearish Outlook

On the flip side, if AST SpaceMobile faces delays in satellite deployment, regulatory hurdles, or competition from larger companies like SpaceX and Amazon, the stock could struggle to gain traction. Some experts believe that the stock could remain stagnant or even decline if the company cannot overcome these challenges.

Should You Invest in ASTS Stock?

Investing in AST SpaceMobile is high risk but also high reward. For those with a high tolerance for risk, it may be worth holding onto ASTS stock with the hope that the company will successfully launch its satellite network by 2025. However, conservative investors may want to wait until the company proves its technology and gains more financial stability before jumping in.

Conclusion

The ASTS stock forecast for 2025 is full of potential, but it comes with significant risks. With the right execution and timing, AST SpaceMobile could become a major player in the global broadband market, leading to substantial stock gains. However, investors should keep a close eye on its upcoming satellite launches, regulatory approvals, and competition.

If you believe in AST SpaceMobile’s mission and are willing to take the risk, this could be an exciting investment opportunity for the future.