If you’re familiar with trading, you’ve probably heard of the “bearish engulfing candle.” This is a popular candlestick pattern used by traders to identify potential market reversals. It’s a signal that can help you decide when to sell or short a stock, currency, or other asset.

.

Breaking Down the Bearish Engulfing Candle

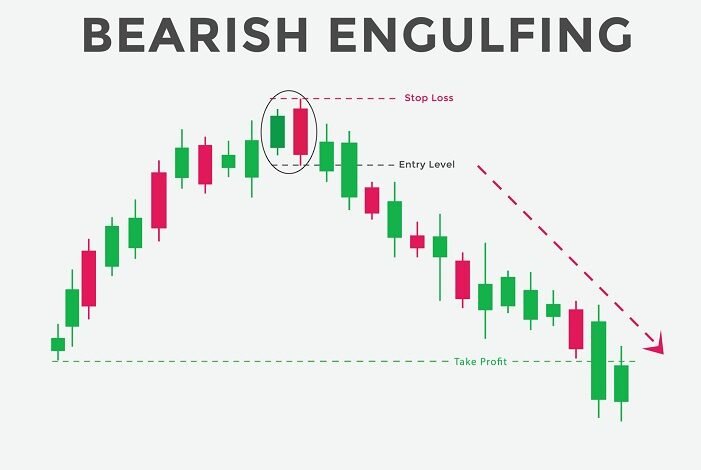

The bearish engulfing candle is a two-candle pattern that typically signals a bearish reversal in the market. Here’s what it looks like:

- The First Candle: This is a smaller, bullish candle (usually green or white) that shows that the price has gone up during that trading period.

- The Second Candle: This is a larger, bearish candle (usually red or black) that completely “engulfs” the body of the first candle. The second candle opens higher than the previous close but closes lower than the previous open, indicating a strong shift in market sentiment.

Why is the Bearish Engulfing Candle Important?

The bearish engulfing candle is important because it suggests that sellers are taking control, pushing the price down. When this pattern appears after an uptrend, it can signal that the trend is about to reverse, making it a useful tool for traders looking to exit a position or take a short trade.

How to Identify a Bearish Engulfing Candle

Identifying a bearish engulfing candle is relatively simple:

- Look for an Uptrend: This pattern usually forms after a period of rising prices.

- Spot the Two-Candle Formation: Ensure the first candle is bullish and the second candle is bearish, with the second candle fully engulfing the first.

- Volume Confirmation: Higher trading volume during the formation of the bearish engulfing candle can strengthen the signal, indicating that many traders are participating in the move.

Trading Strategies Using the Bearish Engulfing Candle

As an experienced trader, I’ve found that there are several ways to use the bearish engulfing candle in your trading strategy:

- Confirmation with Indicators: Use other technical indicators, like RSI or moving averages, to confirm the reversal signal before entering a trade.

- Set Stop-Loss Orders: Place a stop-loss above the high of the bearish engulfing candle to manage your risk in case the market doesn’t reverse as expected.

- Combine with Support and Resistance Levels: If the pattern appears near a resistance level, it can be a stronger signal that the price will drop.

Common Mistakes to Avoid

Even though the bearish engulfing candle is a powerful signal, it’s not foolproof. Here are some common mistakes to avoid:

- Ignoring the Trend: Only use this pattern in the context of an existing uptrend. If there’s no clear trend, the pattern might not be as reliable.

- Not Using Confirmation: Always look for additional confirmation before making a trade based on this pattern. Relying solely on the bearish engulfing candle can lead to false signals.

- Overtrading: Don’t try to force trades every time you see this pattern. It’s essential to be patient and wait for the right setup.

Conclusion

The bearish engulfing candle is a valuable tool for traders who want to spot potential reversals and make informed trading decisions. By understanding how to identify this pattern and using it in conjunction with other technical indicators, you can improve your chances of success in the market. Remember to practice caution, use stop-loss orders, and always confirm the signal before making a move.