CEI Stock Price: What You Need to Know About Camber Energy’s Shares?

If you’re looking into investing in CEI stock, or you’re already familiar with Camber Energy, this blog will provide a complete overview of the stock price, its recent trends, and other key factors to consider. As someone who has followed CEI for a while, I understand the ins and outs of this energy stock and will share important details to help guide your decisions.

What is CEI?

CEI is the ticker symbol for Camber Energy Inc., a small-cap energy company that focuses on oil and natural gas exploration. Headquartered in Houston, Texas, Camber Energy has gone through various ups and downs in its stock value over the past few years due to market volatility, shifting energy demands, and fluctuations in oil prices.

CEI Stock Price Overview

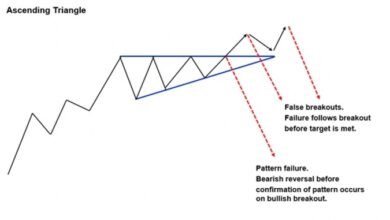

CEI stock is known for its high volatility. The price can experience significant swings in short periods, which makes it both attractive and risky for investors. Historically, CEI has seen large spikes, often driven by market sentiment or company-specific news, but it has also seen considerable drops due to challenges in the energy sector and dilution concerns.

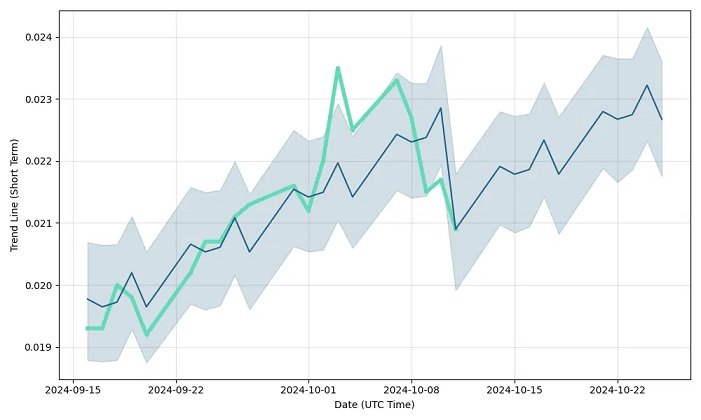

Current Price Trend

As of today, CEI stock is priced around [current price], but it’s important to note that this price changes frequently. Investors need to keep a close eye on it, as the energy market is especially sensitive to news about oil prices, regulatory changes, and global energy demand.

Factors Impacting CEI Stock Price

Several factors affect CEI’s stock price, and being aware of these can help you time your investments or decide when to buy or sell.

- Oil Prices: Camber Energy is highly dependent on the price of oil. If oil prices rise, CEI stock usually benefits. However, a drop in oil prices often leads to a decline in its share price.

- Dilution Issues: Over the past few years, CEI has issued additional shares to raise funds, which has led to dilution. When a company issues more shares, the value of each share decreases unless there’s an equal or greater increase in overall value.

- News and Speculation: Like many small-cap stocks, CEI’s price is often driven by news, speculation, and sentiment in the market. Sudden spikes or drops can occur without any fundamental changes in the company.

- Energy Market Trends: The energy industry is experiencing rapid changes, with shifts toward renewable energy. While Camber Energy primarily deals in oil and gas, it’s important to track how global energy transitions impact the stock.

Should You Invest in CEI?

Investing in CEI comes with both potential rewards and risks. Here are some considerations based on my experience:

Potential Rewards

- High Volatility: CEI stock has the potential for quick profits due to its volatility. If you can buy low and sell during a price surge, there’s a chance for significant returns.

- Oil Price Surge: If oil prices continue to rise, CEI could benefit greatly, increasing its stock price.

Risks

- Market Volatility: The same volatility that creates opportunities for gains also comes with risks of sharp losses. CEI can drop just as quickly as it rises.

- Dilution Concerns: Constant issuance of new shares has worried investors, as it dilutes the value of the stock.

Expert Tips for CEI Investors

- Follow Oil Prices: Since CEI is closely tied to the oil market, monitoring crude oil prices is essential.

- Watch for News Updates: Be aware of any company news, regulatory updates, or major changes in the energy sector that could impact the stock.

- Limit Your Exposure: Given its volatility, it’s smart to limit how much you invest in CEI. Consider it part of a broader, diversified portfolio.

Conclusion

CEI stock offers a lot of potential for investors willing to handle the risks. With its volatility, it’s a stock that can move quickly, making it attractive to traders looking for short-term gains. However, it’s important to be aware of the risks involved, especially if you’re planning a longer-term investment.

By keeping a close eye on oil prices and news related to the energy sector, you can make informed decisions about your CEI investment. With proper research and a good strategy, CEI can be a valuable part of your investment portfolio.