Liqudity Void: What you need to know?

In the world of trading, liquidity is a key factor that influences price movements. But what happens when there’s a sudden lack of liquidity? This is where the concept of a liquidity void comes into play. In this blog post, I’ll explain what a liquidity void is, how it forms, and why it’s important for traders to recognize.

What is a Liquidity Void?

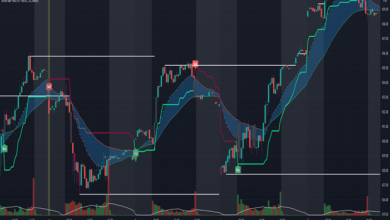

A liquidity void is essentially a gap or an area on a price chart where there was very little trading activity. This void represents a sudden imbalance between buyers and sellers, usually caused by a sharp, rapid price movement. These voids are often seen in volatile markets, where price moves quickly through levels with little or no trading in between. Think of a liquidity void as a vacuum in the market. In this area, there was not enough buying or selling to create a balanced price range, leading to a gap or a thinly traded zone on the chart.

How Does a Liquidity Void Form?

Liquidity voids typically form during periods of high volatility, such as after a major news event, economic data release, or an unexpected market shock. Here’s how it usually happens:

- Market Shock: An event causes a sudden shift in market sentiment, leading to a surge of buying or selling pressure.

- Rapid Price Movement: The price moves quickly in one direction as traders rush to enter or exit positions.

- Lack of Orders: As the price moves rapidly, there are fewer limit orders available in the market to match the buying or selling pressure, creating a gap or thinly traded area on the chart.

- Void Formation: The result is a liquidity void—an area where the price moved with little resistance, leaving behind a gap or an area with very few trades.

Why Liquidity Voids Matter

Understanding liquidity voids is important for several reasons:

- Potential Price Retracements: Markets often revisit liquidity voids to “fill” the gap. This means the price might retrace back to the void area as the market seeks to establish a more balanced price level.

- Trading Opportunities: Liquidity voids can present trading opportunities. For instance, if you notice a liquidity void forming, you might anticipate a potential retracement or reversal as the market attempts to fill the void.

- Risk Management: Recognizing a liquidity void can also help in managing risk. If you’re in a trade and a void is forming, it might be a signal to adjust your position or tighten your stop-loss.

How to Trade Liquidity Voids

Trading around liquidity voids requires careful consideration. Here are a few tips:

- Identify the Void: Look for areas on the chart where the price moved quickly with little trading activity. These are potential liquidity voids.

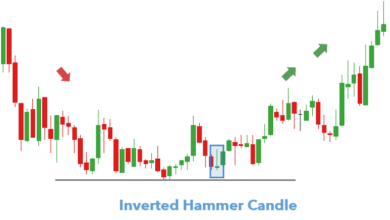

- Wait for Confirmation: Don’t trade just because a void exists. Wait for signs that the market is attempting to fill the void, such as a reversal pattern or an increase in volume.

- Set Your Entry and Exit: If you’re trading a void, set your entry point at the beginning of the void and your exit at the other end of the void. Always use stop-loss orders to manage your risk.

- Consider the Context: Liquidity voids don’t always get filled immediately. Consider the broader market context, such as trends and other technical indicators, before making a trade.

Final Thoughts

Liquidity voids are an interesting aspect of market behavior that can offer insights into price movements and trading opportunities. By understanding what they are and how they form, you can use them to your advantage in your trading strategy. However, always remember to approach them with caution and to use them in conjunction with other analysis tools.