When trading in the financial markets, one of the most critical decisions traders face is choosing the right time frame for their strategies. If you’re using the Williams Alligator indicator, selecting the appropriate time frame can significantly impact your success. This post will break down the best time frames to use with the Williams Alligator indicator and explain why they matter.

Understanding the Williams Alligator Indicator

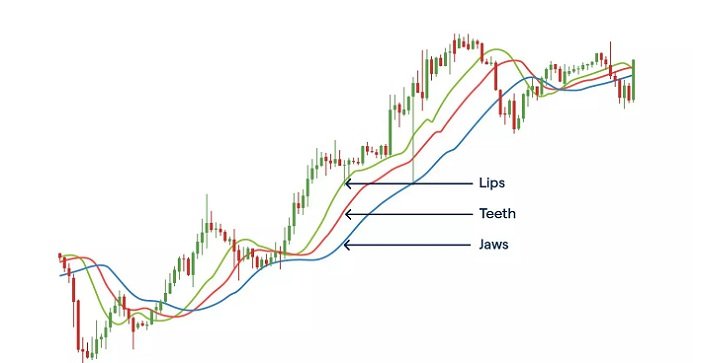

Before diving into time frames, let’s quickly review what the Williams Alligator indicator is. Developed by Bill Williams, this indicator is a trend-following tool that uses three smoothed moving averages: the Jaw, Teeth, and Lips. These lines help traders identify the direction of the trend and potential turning points in the market.

- Jaw (Blue Line): A 13-period moving average smoothed by 8 bars.

- Teeth (Red Line): An 8-period moving average smoothed by 5 bars.

- Lips (Green Line): A 5-period moving average smoothed by 3 bars.

The Alligator metaphor comes from the idea that these lines “open” and “close” like an alligator’s mouth, signaling the market’s state (trending or ranging).

Know more about: Trading Edge Simulator Free.

Choosing the Right Time Frame

The time frame you choose for the Williams Alligator depends on your trading style and goals. Here’s a breakdown of different time frames and when to use them:

1. Short-Term Trading (Scalping and Day Trading)

- Time Frame: 1-minute to 15-minute charts

- Why Use It: If you’re a scalper or day trader, you’re looking for quick moves and opportunities to capitalize on small price fluctuations. The Williams Alligator can help you spot short-term trends and potential reversals quickly on these lower time frames.

2. Medium-Term Trading (Swing Trading)

- Time Frame: 1-hour to 4-hour charts

- Why Use It: Swing traders aim to catch medium-term trends that can last from a few days to several weeks. The Williams Alligator works well on these time frames because it can help identify the beginning of a trend, allowing you to ride it for a more extended period.

3. Long-Term Trading (Position Trading and Investing)

- Time Frame: Daily to Weekly charts

- Why Use It: If you’re a position trader or investor, you’re more interested in long-term trends. The Williams Alligator on daily or weekly charts can help you stay aligned with the overall market direction, ensuring you’re not caught in short-term market noise.

How to Apply the Williams Alligator in Different Time Frames

No matter what time frame you choose, the principles of using the Williams Alligator remain the same:

- Identify Trends: Look for the Alligator’s mouth to “open” (lines diverging) in the direction of the trend.

- Stay Out of Ranges: When the Alligator’s mouth is “closed” (lines converging), it signals a lack of trend or range-bound market—an ideal time to stay on the sidelines.

- Confirm with Other Indicators: To increase accuracy, combine the Alligator with other indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) for additional confirmation.

Final Thoughts

In conclusion, there’s no one-size-fits-all answer to the best time frame for using the Williams Alligator indicator. The key is to match the time frame with your trading style. Short-term traders will benefit from lower time frames, while long-term traders should focus on higher time frames. Experiment with different charts, see what works best for you, and always remember to manage your risk.